|

| Tuesday, 23 January 2018, 18:00 HKT/SGT | |

| |  | |

Source: Warc | |

|

|

|

|

| Global Ad Trends - A focus on advertising expenditure |

LONDON, Jan 23, 2018 - (ACN Newswire) - WARC, the international marketing intelligence service, has released its latest monthly Global Ad Trends report digesting up-to-date insights and evidenced thinking from the worldwide advertising industry.

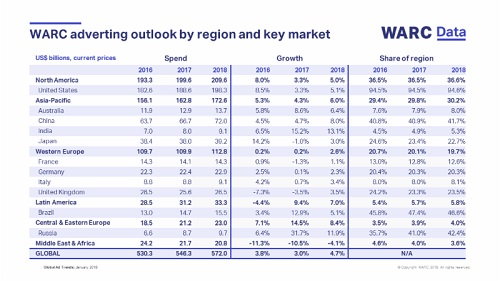

| | WARC global ad spend outlook by region & key market chart |

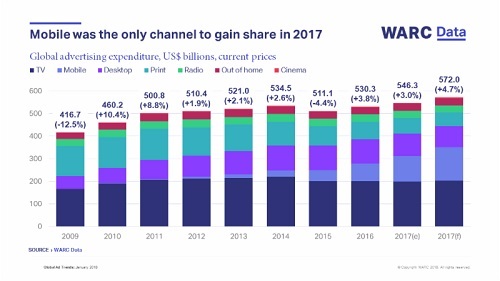

| | Mobile was the only medium to gain ad spend share in 2017 chart |

Focusing on advertising expenditure in 96 markets, this latest Global Ad Trends report includes key trends in spending patterns by media and geography since 2009, a round-up of 2017, as well as full-year projections for 2018.

Global advertising expenditure growth to accelerate to +4.7% in 2018

Global growth is forecast at 4.7% to a total of US$572bn this year, boosted by the PyeongChang Winter Olympics, FIFA World Cup, US mid-term elections and reduced dollar volatility in emerging markets.

Growth in North America (+5.0%), Asia-Pacific (+6.0%) and Western Europe (+2.6%) is expected to hasten in 2018, while Central and Eastern Europe (+8.4%) and Latin America (+7.0%) will continue to expand at a strong rate. Advertising spend across the Middle East and Africa is expected to dip once more (-4.1%), though at a lesser rate than in previous years.

Global advertising expenditure rose 3.0% to US$546bn in 2017

Global advertising spend rose 3.0% to US$546bn in 2017, according to new projections based on data for 96 markets. The growth rate in 2017 represents a slowdown from the 3.8% rise recorded in 2016, partially owing to weaker growth in the United States (which accounts for 34% of the value of advertising worldwide).

The slowdown in the US contributed to an easing in growth across North America as a whole. Adspend in the region rose 3.3% to US$199.6bn in 2017 (compared to 8.0% growth in 2016). Growth in the world's second-largest ad region, Asia-Pacific, also cooled (+4.3% to US$162.8bn in 2017 vs +5.3% in 2016), as growth in Japan (23% of the regional total) was muted by a weaker Yen. The Chinese ad market - which accounts for 41% of Asian and 12% of global advertising spend - expanded by 4.7% to US$66.7bn last year, propelled by rapidly increasing spend on mobile ads.

North America and Asia-Pacific account for two-thirds of global advertising expenditure combined. Outside of these regions, fortunes were mixed. Spend in Western Europe (20% of the global total) rose by just 0.2% to US$109.9bn in 2017, matching the rate recorded in 2016. Conversely, advertising spend in Central and Eastern Europe grew by 14.5% to US$21.2bn in 2017, making it the fastest-growing region last year. The Latin American ad market returned to growth (+9.4% to US$31.2bn in 2017) after a 4.4% decline in 2016, but advertising spend in the Middle East and Africa fell for a second year (down 10.5% to US$21.7bn in 2017 versus an 11.3% dip in 2016) due to political instability and the impact of a weaker trade price on oil-reliant economies.

Mobile was the only medium to gain share of global advertising expenditure in 2017, and is now the world's second-largest ad channel

Mobile increased its share of global advertising expenditure by an estimated 5.9 percentage points (pp) to 20.6% in 2017, equivalent to US$112bn (up 44.5% year-on-year). Approximately 45% of mobile advertising spend is based in the US, where US$156 dollars per capita is spent on mobile ads.

Mobile is thought to have been the only media channel to have gained share year-on-year. Estimates indicate that mobile overtook desktop internet for the first time in 2017, as spend on desktop ads was thought to have taken a share of 18.3% (down 1.9pp year-on-year).

The largest media channel, TV, is estimated to have registered a 1.4pp dip in 2017, taking a share of 36.5% of the global adspend total (US$199.5bn). Print continues to lose share, the channel was down an estimated 2.2pp in 2017 to 12.5%. Since 2009, print has recorded a massive 21.5pp decrease in its share of global adspend, and has lost an average US$11.5bn each year since 2012.

Out of home's share dipped by 0.1pp to 5.7% in 2017, while cinema's share held at 0.7% and radio was down by an estimated 0.2pp to 5.7%.

James McDonald, Data Editor, WARC, says: "2018 should be a stellar year for global advertising, with ad investment set to grow at its strongest rate since the post recovery years of 2010 and 2011. All global regions, with the exception of the Middle East, are expected to register growth, supported by key quadrennial events - notably the Winter Olympics in South Korea, the FIFA World Cup in Russia and the US mid-term elections."

He added, "Mobile is now a key driver of global growth, and was the only channel to gain share of spend in 2017 - it now accounts for one in five ad dollars worldwide. Nevertheless, traditional media still attract 61% of global ad investment, and TV and out of home will be among the main benefactors of increased brand and political campaign spending this year."

A round-up of advertising expenditure trends and media projections

- 3.0% rise in global adspend last year, to a total of US$546bn

- 4.7% growth forecast for global adspend this year, reaching US$572bn

- 18% - search's share of global adspend in 2017

- 40% average growth rate in online video spend since 2013

- 45% of global mobile adspend in 2017 was based in the US

- 61% of global adspend in 2017 (US$334.1bn) invested in traditional media

Other new key media intelligence on WARC Data

- More ad dollars go to TV networks (US$199.5bn) than the Facebook/Google duopoly (US$133.2bn)

- TV adspend outweighs online video by a ratio of 6:1

- At US$65.8bn, sponsorship will overtake print to become the fourth-largest ad medium in 2018

Global Ad Trends is part of WARC Data, a newly enhanced dedicated online service featuring current advertising benchmarks, data points, ad trends and user-generated expanded databases.

Aimed at media and brand owners, market analysts, media, advertising and research agencies as well as academics, WARC Data provides current advertising and media information, hard facts and figures - essential market intelligence for ad industry related business, strategy and planning required in any decision making process.

WARC Data is available by subscription only. For more information visit www.warc.com/data.

Contact:

Amanda Benfell

PR Manager

+44 20 7467 8125

amanda.benfell@warc.com

Topic: Press release summary

Source: Warc

Sectors: Media & Marketing, Advertising

https://www.acnnewswire.com

From the Asia Corporate News Network

Copyright © 2024 ACN Newswire. All rights reserved. A division of Asia Corporate News Network.

|

|

|

|

|

|

|

|