|

| Thursday, 29 March 2018, 10:00 HKT/SGT | |

| |  | |

Source: Warc | |

|

|

|

|

| Global Ad Trends - A focus on threats to the digital advertising ecosystem |

LONDON, Mar 29, 2018 - (ACN Newswire) - WARC, the international authority on advertising and media effectiveness, has released its latest monthly Global Ad Trends report, digesting up-to-date insights and evidenced thinking from the worldwide advertising industry. Threats to the digital advertising ecosystem is the focus of the latest report.

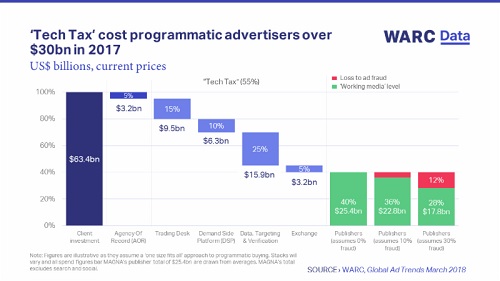

| | 'Tech Tax' cost programmatic advertisers over $30bn in 2017 chart |

| | WARC Data dark logo |

| | WARC Data white logo |

| | James McDonald, Data Editor, WARC |

WARC estimates that $63.4bn was spent on programmatic advertising worldwide last year, but as little as $17.8bn (28%) may have actually made it to the 'working media' level.

Programmatic's role in ad trade is increasing rapidly: two in every five dollars (39%) spent on advertising in the US last year - across all media and formats - were traded by machines. This rate has doubled over the last five years.

With a continued and rapid rise in digital advertising, concerns have surfaced within the industry. Over half of the senior marketers surveyed by the CMO Council cited social media risks and reputation management as a major issue. One in three highlighted ad fraud, ad misplacement, and viewability as concerns, while a quarter cited media buying transparency and accountability.

WARC provides the following evidence for each of their main concerns:

Media transparency and accountability: 'Tech Tax' cost programmatic advertisers over $30bn in 2017

The World Federation of Advertisers (WFA) believe some 55% of investment goes towards what some have dubbed the 'tech tax' (the money spent on trading desks, demand side platforms, ad exchanges and data, targeting and verification services). WARC drew a consensus from media buyers, and while the rate of tech tax varied between markets, agencies and stacks, the outcome broadly aligned with the WFA estimates.

The tech tax would equate to $34.9bn. The true figure will be closer to $30bn, as platforms where the tech is integrated (such as YouTube's Trueview) cloud the calculation.

After agency fees, of the $63.4bn in estimated programmatic advertiser spend last year, only $17.8bn made it to the 'working media' level when assuming a 30% fraud rate.

Reputation management: Brand perception changes with negative adjacency, and one in five consumers will take direct action

One in five (19.5%) consumers state that they would take some form of direct action against a brand if its advertising appeared alongside objectionable content, either by boycotting the brand (10.5%) or being vocal/raising issue (9.0%).

43% of senior marketers claim that they have already had reputation problems after ads had appeared next to objectionable content. Almost two in five (37%) have pulled or intend to pull ads as a result.

Ad misplacement: Programmatic video ads pose greatest risk to brands

Ad misplacement - the risk of a legitimate ad appearing on an undesirable site or next to objectionable content - varies significantly by market, format, and buy type. The average risk for desktop display ads across 11 key markets was 6.9%.

The issue is particularly prevalent in the Americas. One in ten (10.2%) desktop impressions in Brazil were flagged on moderate to very high-risk inventory, followed by the US (9.4%) and Canada (8.4%). The risk was lowest in Singapore (3.4%).

Data for the second half of 2017 show that brand risk is routinely higher when the ad is bought programmatically. This is particularly true for video ads.

Ad fraud: Most ads are not optimised against fraud and remain vulnerable. One in three clicks on programmatic ads is fraudulent

The Association of National Advertisers (ANA) estimates that around $6.5bn was lost to ad fraud worldwide last year. Total losses could have been cut to $700m if the entire industry had adhered to safety guidelines.

Non-optimised ads remain vulnerable. Fraud rates for desktop display ads vary by key market: Italy (16.1%), Germany (15.9%), France (14.6%), US (11.3%), Japan (8.4%), UK (8.3%), Australia (7.7%), Spain (3.0%).

Aside from fraudulent impressions, click fraud is also prevalent online. Data show that as many as three in four clicks on programmatically purchased 300 x 600 'half page' ads (a unit Google describes as one the fastest growing sizes) are fraudulent. On average, one in three clicks on programmatic ads across all sizes and platforms is fraudulent.

Viewability: Almost half of programmatic ads do not meet Media Rating Council standard. Only one in four viewable desktop ads is actually seen

Programmatically purchased ads routinely under-perform in terms of viewability when assessed against the Media Ratings Council standard. On average, almost half (46%) of programmatic ads are not viewable.

Even if the ad is viewable, it is unlikely to be seen. Data show that only one in four (23%) of the desktop display ads defined as viewable by the Media Rating Council (MRC) standard are actually viewed, with only 4% of measured ads seen for more than one second.

Social media risks: Social media provides the least-safe environment, with 300m+ worthless accounts

10% of Facebook's 2bn monthly users are duplicate accounts, according to company reports. The number of fake accounts is estimated to be between 2-3% by Facebook, suggesting that as many as 265m accounts could be worthless to advertisers.

Separate research shows that, on average, 16.4% of the followers on Instagram's top 20 accounts are fraudulent and as many as 15% (49m) of Twitter's users don't have an offline identity.

Summing up, James McDonald, Data Editor, WARC, says: "The boom in programmatic advertising over recent years has exposed major flaws in the ecosystem, including heightened brand risk, impression and click fraud, and poor viewability and dwell time. This has led advertisers - who collectively paid $30bn to 'middlemen' in the online ad supply chain last year - to reassess the way they invest and keep pressure on the industry to clean up its act."

Global media analysis: A round-up of digital threats

- 8% average fraud rate for non-optimised programmatic ads

- 11% risk of negative adjacency with programmatic ads

- 13% of Facebook accounts are worthless to advertisers

- 20% of consumers that would take direct action against a brand due to negative adjacency

- 23% of viewable desktop ads are actually seen

- 32% average rate of click fraud for programmatic ads

- 46% of programmatic ads do not meet Media Ratings Council standard

- 55% rate of 'tech tax' within the programmatic chain

- 76% click fraud rate for programmatic half page desktop ads

Other new key media intelligence on WARC Data

- Google leverages market share to move industry towards ad filtering

- Mobile's share of global adspend will exceed its share of daily consumption this year

- Globally, Facebook is charging more for fewer clicks

Global Ad Trends is part of WARC Data, a dedicated online service featuring current advertising benchmarks, data points, ad trends and user-generated expanded databases.

Aimed at media and brand owners, market analysts, media, advertising and research agencies as well as academics, WARC Data provides current advertising and media information, hard facts and figures - essential market intelligence for ad industry related business, strategy and planning required in any decision making process.

WARC Data is available by subscription only. For more information visit https://www.warc.com/data

Contact:

Amanda Benfell

PR Manager

+44 20 7467 8125

amanda.benfell@warc.com

Topic: Press release summary

Source: Warc

Sectors: Media & Marketing, Advertising

https://www.acnnewswire.com

From the Asia Corporate News Network

Copyright © 2024 ACN Newswire. All rights reserved. A division of Asia Corporate News Network.

|

|

|

|

|

|

|

|