|

| Wednesday, 10 July 2019, 21:00 HKT/SGT | |

| |

|

|

|

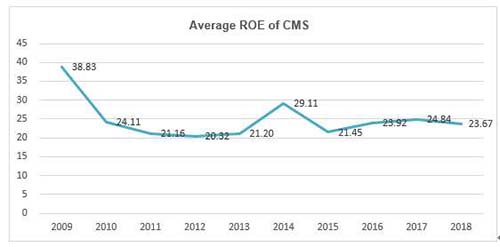

HONG KONG, July 10, 2019 - (ACN Newswire) - If there is an indicator to measure whether the company is good or not from Buffett's perspective, it's believed that most investors will choose ROE (Return on Equity). According to some investors' statistics, the investment return of the company with higher ROE is significantly higher than the market's average return on investment (ROI).

| | Sources: Wind |

| | Sources: Wind |

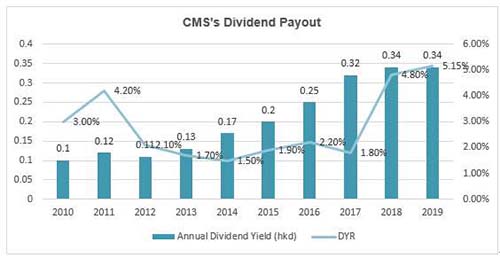

| | Sources: Organized from the Public Information. Notes: DYR for the year 2010-2018 is calculated based on the stock price at the last trading day of the year; DYR for the year 2019 is the dividend per share of the year 2018 divided by the closing price on 19th June, 2019.

|

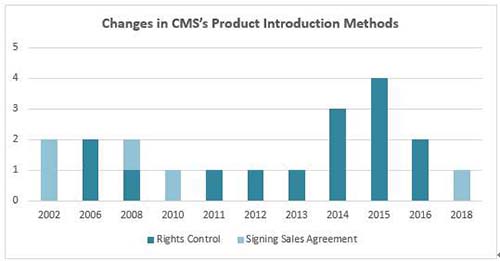

| | Sources:Company Announcement. Notes:Only Commercialized Products Included above

|

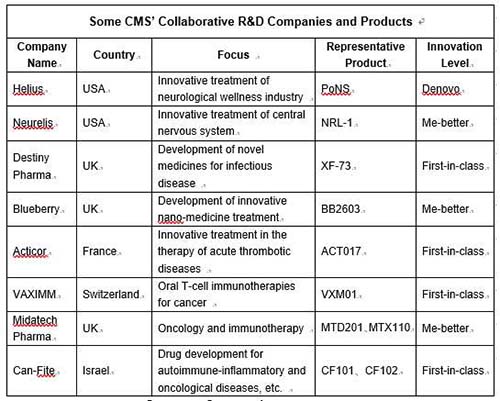

| | Sources:Company Announcement. Notes: Except signing rights permission with Can-fite, CMS's collaborative model with the rest of companies is equity investment; as a medical device, PoNS's innovation level is parallel to "first-in-class" drugs.

|

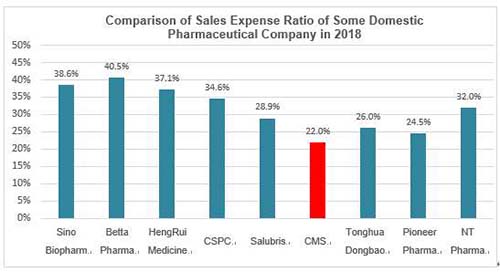

| | Sources: Wind. Note: Some pharmaceutical companies have Active Pharmaceutical Ingredient (API) business which could relatively lower the sales expense ratio; CMS's sales expense ratio excludes the effect of "two-invoice system"

|

| | Sources: Wind |

| | Sources: Organized from the Public Information |

| | Sources: Company Announcement. Notes: the revenue of 2017 and 2018 exclude the effect of "two-invoice system" |

| | Sources: Futu Securities |

Based on the performance of A-shares from 1st Jan 2016 thru 31 Dec 2018, the return of the Shanghai Composite Index is -25.21%, and the return of the Growth Enterprise Index is -50.68%. However, the return of the company with ROE over 10% is -16.35%, while the return of the company with ROE over 15% is 10.15%.

It seems that the differences will be more obvious if we lengthen the time range from 1st Jan 2008 to 30th April 2019, the Shanghai Composite Index decreased by -41.62%, while the share price of the company with ROE over 10% for ten consecutive years rose 131.12%.

More importantly, the average ROE of China Medical System (CMS) has maintained more than 20% for a decade, which is rare among companies in pharmaceutical industry and the whole A+H shares.

If ROE is Buffett's first priority in company selection, PE may be the indicator for him to determine the timing of investment since Buffett's stock-picking philosophy can be summarized as "finding a business with a wide and long-lasting moat + the reasonable price with margin of safety". However, the valuation of CMS is now only 7.3 times PE-TTM.

What does the 7.3 times PE mean? It should be the valuation of the cyclical stocks rather than the pharmaceutical stocks! Moreover, in terms of the dividend yield ratio (DYR), the DYR of CMS is over 5% in 2019.

Looking at Buffett's investment history, we could find out that he often buys shares of the leading consumer-goods companies with strong profitability such as Coca-Cola at bargain prices when market undergoes systemic risks or the company suffers crisis. As we know, with the gradual release of policy risks, the prices of many pharmaceutical stocks have halved or suffered even greater decline in 2018-2019, and the stock price of CMS once dropped by 70%. Therefore, is it the right time to invest in CMS?

I. Transition from CSO to R&D-oriented Pharmaceutical Company

1. CMS's Main Business

In early years, CMS was well-known as a CSO, and its main business model was to introduce drugs from overseas small and medium-sized, innovative pharmaceutical companies to Chinese market, and then engages in the drugs' promotion and marketing. The business model has probably continued to the year of 2010, and several drugs with relatively larger revenue contribution were introduced during the early CSO stage. For instance, Ursofalk was introduced from Dr. Falk Pharma GmbH, Germany in 2002; Deanxit was introduced from Lundbeck, Danmark in 2002; Salofalk was introduced from Dr. Falk Pharma, Germany in 2008; and Bioflor was introduced from Biocodex, France in 2010.

However, since 2011, CMS has transferred its product introduction model from CSO to rights control or China's asset-purchase. For instance, the two products with relatively larger revenue contribution - Plendil and Xinhuosu, among them, Plendil was acquired from AstraZeneca in 2016, and Xinhuosu was acquired from Tibet Rhodiola Pharmaceuticals ("Tibet Pharma") in 2008.

2. Transforming into R&D-oriented Company in the New Era

It has been mentioned above that CMS has made changes in its operation or product introduction model during the past few years. While looking into the characteristics of its products, most of them are with expired patents. From the perspective of industry development trend, working on the R&D of innovative products with patent protection will be the inevitable choice for the companies.

Under the new round of drug approval reform, innovative drugs would be the irresistible trend. Meanwhile, an increasing number of innovative R&D companies have emerged in the capital market, and more and more McAb and X-tinid drugs appeared in the new drugs market. And then there is an interesting question-for new drugs R&D, pursuing hotspots or exploring a different path?

According to the degree of innovation, innovative drugs / medical devices can be divided into 4 categories: me-too, me-better, first-in-class and global-new.

As mentioned before, driven by the policy factors, market demands, talents and etc., the domestic innovative drugs industry enjoys booming development. While limited by several factors including the current situation of fundamental scientific research in China, admittedly most of domestic innovative pharmaceutical companies mainly conduct innovation around me-too drugs R&D, which is not significantly different from generic R&D in nature. Because either from the efficacy or competition landscape, me-too innovative drugs would face price war, or channel and expense competition that generics suffered. Therefore, the return of me-too drugs R&D are destined to be low despite of a higher success rate, especially against the background where China is experiencing a skyrocketing clinical trial cost.

As for the development process of the new drugs, the more innovative parts mainly lie in the discovery phase in pre-clinical stage and verification phase in early-mid stage. For the companies that only focus on me-too R&D, their innovation capability is nothing more than programmatic work of phase III clinical trial, as the me-too new drugs do not require much early discovery and verification. Therefore, it is obviously problematic to define the innovation level of a company by high R&D expense generated from the phase III clinical trials. Surely, this kind of new-drug development model is not suitable for small and medium-sized pharmaceutical companies.

On another hand, return of innovative product R&D declines year by year. According to the report published by Deloitte in 2018, world's top 12 pharmaceutical companies only received 1.9% of return on R&D investment, which is the lowest in the past 9 years. Innovative products R&D cost is going up as the average cost of developing a new product from scratch is 2.18 billion US dollars, while the peak sales of innovative products is going down. The report shows that the average expected peak sales of newly launched drugs only be 407 million US dollars. In conclusion, for Chinese pharmaceutical companies, it's currently hard to be a real innovator to develop innovative drugs.

3. CMS's R&D Model

For the pharmaceutical companies with a special business model, like CMS, what's the direction of innovation and transformation? We can briefly review the CMS's development path mentioned before to understand how it transforms into an innovation-oriented enterprise.

CMS has no gene of generics and me-too drugs, as it has not been involved in generics since the very beginning. Moreover, it proves that the innovation is CMS's strategic positioning from the R&D process of Tyroserleutide (CMS024), which has been conducted by the company and the R&D company owned by its major shareholders since early years.

However, limited by the objective reality, it's difficult for domestic companies to carry out large-scale original R&D. Even for the leading MNCs, most of their innovative drugs are licensed-in. Data indicates that the revenue generating from licensed-in drugs has reached 72% of overall US drugs market. Many blockbuster drugs were no longer self-manufactured by pharmaceutical companies but purchased from other companies, such as Adalimumab from Abbvie, several anti-tumor McAbs from Roche.

What CMS is doing now is more similar to what these MNCs had done in their early years. Through participating in R&D process at different stages by purchasing or investing in relevant products' rights under the collaborative R&D model, the company has established and constantly improved its own new-drug R&D system, improving its new drugs R&D capability. However, as a domestic medium-sized pharmaceutical company, it is necessary to avoid the hotspots competed by leading MNCs. It should be noted that CMS has focused on specialty competition for many years, and the historical records also proved its strategic success.

Of course, new-drug R&D has risks, especially for highly innovative drugs, particularly global-new and first-in-class products. CMS's acquisition of new projects in recent two years indicates that the company reduces its R&D risk through diversifying its drug portfolio.

To be specific, besides global-new or first-in-class products, CMS has also introduced some products with higher R&D success rate into its pipeline, such as me-better product-- Intranasal Diazepam of 505b2 category. However, we do not rule out the possibilities that CMS will introduce products in mid-late clinical stages or even commercialized products in the future.

4. Selected R&D Projects

Let's analyze CMS's R&D positioning and strategy with the example of NRL-1 (Intranasal Diazepam), which is developed relatively faster under CMS's collaborative R&D model.

NRL-1, Intranasal Diazepam, was developed by Neurelis for the treatment of Acute Repetitive Seizures. Neurelis has submitted the US FDA marketing approval application in September, 2018. Its application for marketing approval in China is also under preparation.

NRL-1 aims to solve the difficulty of injecting diazepam to epilepsy patients and issue of drug action duration. As it is easy to use and effectively shorten the duration of epileptic attack with high bioavailability, NRL-1 has a significant clinical advantage. According to the research report from US Neurology Annual Conference hosted by the University of Pennsylvania in May, 2019, diazepam nasal spray is safe and well-tolerated with higher bioavailability for patients suffering cluster or acute repetitive seizure. Among the total of 1,585 seizure attacks treated with nasal spray in this study, a single dose of diazepam was effective to cease a epileptic attack for 1,457 times.

At present, among approximately 6 million patients with active epilepsy in China, only 2 million have received formal treatment, 20% to 30% of whom are still at the risk of repetitive seizures without effective control.

The example of NRL-1 can reflect that CMS's R&D strategy is 'Innovation' plus 'Specialty'. 'Innovation' means that the product belongs to me-better category with obvious advantages compared to the traditional diazepam injection. 'Specialty' means that the company is able to avoid the competition against MNCs as the product is not in global hotspot field; Moreover, the product's clinical needs and therapeutic advantages guarantee its market potential and profitability.

II. Academic Promotion with Increasingly Prominent Advantages

After the volume-based purchase policy was issued, some investors might think that the marketing capability is no longer significant, and even unnecessary, while R&D capability is increasingly important. I think the view has two sides. For the majority of the generics, large marketing expenses and promotion teams might not be necessary. But for the innovative products, the promotion of products and the education for both doctors and patients will always be necessary, which is also a crucial part of the value chain in pharmaceutical industry, especially for the innovative drug industry.

1. The Necessity of Academic Promotion

For all industries including pharmaceutical industry, promotion, communication and education are necessary when a new product is launched to the market. But for the pharmaceutical companies, the ways of promotion and communication are more special.

Besides, we need to distinguish academic promotion from commission-based promotion. Drawing the line between them is undeniably difficult, but the promotion model with large commission involved will be criticized undoubtedly, especially for the common generics with highly developed market.

Over years, the profit margin of selling generic drugs in China has been squeezed, which means the value of authentic academic promotion will be highlighted and valued. Particularly in the era of the innovative drugs, academic promotion itself is the indispensable weapon to conquer the market.

2. The Excellent Academic Promotion Ability

According to the 2018 Annual Report of CMS, the company employs around 2,800 promotional staff and its promotional network covers about 53,000 hospitals and medical institutions across China.

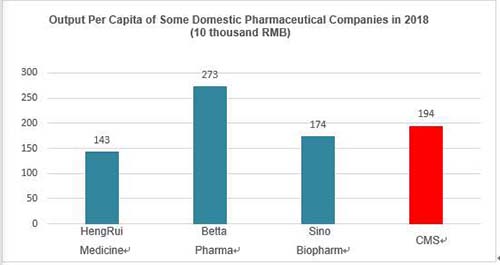

Compared with the domestic first-line pharmaceutical companies, the promotion team of CMS is highly efficient: the 2018 sales expense ratios of HengRui Medicine and Betta Pharma (A-share companies) were 37% and 41% respectively, and Sino Biopharm and CSPC (H-share companies) were 39% and 35% respectively; while that of CMS during the same period was about 31%, and it would be merely 22% if excluding the effect of "two-invoice system".

Obviously, CMS's promotion team is not large-scale and the sales expense ratio is not high as well, but the indicators such as output per capita of sale staff have the leading position in the industry. We think the main reason is that the projects selection and positioning strategies made by upstream tend to fit for the downstream promotion model. Meanwhile, high-quality promotion staff and strong multi-therapeutic departments coverage ability also contribute to the high output. Certainly, the deeper reason may be that sales commission is a necessary cost for many generics or me-too drug companies under the homogeneous competition. The sales expense ratio of 20-30% should be considered as normal among the top global pharmaceutical companies.

3. Evaluating CMS's Promotion Capability from the Performance of Xinhuosu

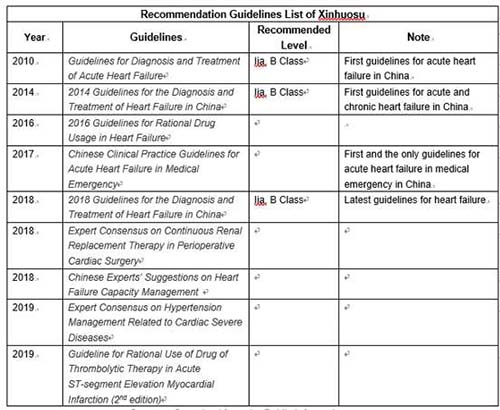

Xinhuosu (Recombinant Human Brain Natriuretic Peptide) is used in the treatment of acute and chronic heart failure; it is the National Class One New Drug as well as the only Recombinant Human Brain Natriuretic Peptide ("rhBnp") currently available in the China market. In 2005, Tibet Pharma was the first company that received the approval to produce and sell Xinhuosu.

In early years, the Tibet Pharma authorized Xinhuosu's exclusive sales contract to Guangdong KangHong, YiBai Pharma and Hong Kong Core Healthcare respectively, but all of them failed to perform well in product's promotion. Xinhuosu's sales revenue was less than RMB 5 million in 2007 and never picked up until CMS took it over in 2008. By the end of 2018, its annual sales revenue reached RMB 335 million, which was RMB 887 million if excluding the effect of "two-invoice system".

It should be noted that the growing sales of Xinhuosu depends on CMS's academic promotion supported by the various academic evidences of clinical trials, rather than the promotional strategies of generics or me-too drugs including increasing expenses or relying on channels.

The post-marketing IV clinical trial conducted by CMS for Xinhuosu has been the largest rhBnp study in China so far. The large-scale clinical research was led by Society of Cardiovascular of China Medical Association with 8 clinical centers and 2,160 recruited patients with acute and chronic heart failure. The clinical data showed that the clinical application of rhBnp decreased the incidence rate of adverse events, improved the dyspnea level of the patients, decreased NT-proBNP, and increased left ventricular ejection fractions.

In addition to large-scale clinical trials, Xinhuosu has also been recommended by several authoritative guidelines for the diagnosis and treatment of heart failure after the academic promotion of CMS. Moreover, Xinhuosu has been included in the National Reimbursement Drug List through national negotiation in 2017, and its sales revenue has maintained a high growth rate.

Why CMS could achieve good sales performance of Xinhuosu? In addition to the company's academic promotion capability, the characteristics of the product itself are also important. The most obvious characteristic is being differential, which is also one of the substantive characteristics of innovation. For instance, Xinhuosu is the only rhBnp available in China at present without positive inotropic action or any increase on myocardial oxygen consumption; and it has multiple action mechanisms. All of these can differentiate the product from other drugs in the same field.

The example of the Xinhuosu shows that CMS's excellent academic promotion capability mainly comes from its products screening abilities, R&D and even strategy orientation. In other words, the potential could be maximized only when authentic innovative products integrate with excellent academic promotion capability.

III. Talking about CMS's Current Status and Volume-based Purchase Based on Its Stock Price Performance

Reflecting on CMS's stock price performance since 2018, the stock price has plummeted more than 60% from its historic highs during the same period last year, and the volume-based purchase may be the core reason. As mentioned in the beginning of the article, the company's major products are mainly originators with expired patents. However, the core purpose of volume-based purchase is to gradually replace the originators with the generics with low price, zero promotion and zero channel expenses. Therefore, the market has avoided branded-drugs-oriented companies like CMS.

It cannot be denied that the branded drugs would face greater policy pressure. However, drug substitution is a process, and the replacement speed would be different in terms of different types of drugs on different channels.

First of all, none of the company's products has been included in the volume-based purchase list. Whether or not the company's products will be included in the second or third batches of the volume-based purchase list still depends on if any generic drug could pass the consistency evaluation. Currently, the company has 20 products in its portfolio, among these, products with relatively higher sales contribution are 4 exclusive products (Bioflor, Stulln, Hirudoid, and Combizym), 2 exclusive dosage-form chemical drugs (Ursofalk and Salofalk), and a biological agent, Xinhuosu, which is originally immunized from the volume-based purchase. Therefore, among the large-weighted products, only the generics of Deanxit has passed the consistency evaluation and it might face the risk of a price reduction from volume-based purchase, while Plendil might encounter the risk of volume-based purchase in the medium term.

Secondly, the originator products with large-weight on the company's sales are mainly for chronic diseases, such as Plendil and Deanxit. These drugs have stronger consumer attributes, mainly embodied in two aspects, channel and brand. Firstly, for the channel, the OTC sales revenue of both Plendil and Deanxit contribute over 30% of their sales, and the company also strengthens its OTC channels construction. Against the background of hierarchical diagnosis and prescription outflow, the non-hospital market is likely to be the main market for chronic diseases. Secondly, for the brand, anti-hypertensive and anti-depressant drugs are all long-term used medicines with low unit price, so there must be a certain amount of patients with strong loyalty. Even if such drugs would be included in the volume-based purchase list, it is hard to predict whether the performance of the company would be the same as its share price suffered.

Finally, the impact of volume-based purchase might not be as terrible as we think. The current stock price has priced-in all of the negative aspects, even though the company's products have not reduced their prices or lose the market.

As mentioned above, CMS is no longer a CSO. It has been transformed from a company that promoted patent-expired originators to an innovation-oriented pharmaceutical company.

In terms of the basic indicators such as cash flow, valuation and dividend yield ratio, investing in CMS now is more like buying a sound and valued-based stock, while bundling a portfolio of innovative drugs options with a promising return.

By Gelonghui

Topic: Press release summary

Sectors: Daily Finance, Daily News, Healthcare & Pharm

https://www.acnnewswire.com

From the Asia Corporate News Network

Copyright © 2024 ACN Newswire. All rights reserved. A division of Asia Corporate News Network.

|

|

|

|

|

|

|

| |

Latest Press Releases

Edvantage Group Announces FY2024 Interim Results

Apr 26, 2024 13:43 HKT/SGT

|

|

|

Internationally Renowned Botulinum Toxin Experts Join WizMedi Bio's New Botulinum Toxin Development Project

Apr 26, 2024 13:27 HKT/SGT

|

|

|

Imexpharm Corporation Hosts Shareholders, Analysts and Potential Investors at its 2024 Annual General Meeting

Apr 26, 2024 13:16 HKT/SGT

|

|

|

UK advertising reports GBP36.6bn spend in 2023

Apr 26, 2024 11:00 HKT/SGT

|

|

|

JCB enables JCB Contactless acceptance at Taichung MRT in Taiwan

Friday, April 26, 2024 9:00:00 AM

|

|

|

Jeff Martin Auctioneers to Manage Sale of Sabine Mining Company Assets for North American Coal

Apr 26, 2024 08:00 HKT/SGT

|

|

|

Cambridge Isotope Laboratories (CIL) Shows Long-Term Commitment to Xenia, Ohio, Facility With New Land Purchase

Apr 25, 2024 21:00 HKT/SGT

|

|

|

Black Spade Donates Art and Jewellery Collection To Hong Kong Red Cross

Apr 25, 2024 20:40 HKT/SGT

|

|

|

Q2 Metals Announces Assay Results from Its 2023 Inaugural Drill Program at the Mia Lithium Property, James Bay Territory, Quebec, Canada

Apr 25, 2024 19:09 HKT/SGT

|

|

|

Mazda Production and Sales Results for March 2024 and for April 2023 through March 2024

Thursday, April 25, 2024 5:21:00 PM

|

|

|

|

|

More Press release >> |

|

|

|