|

|

|

|

|

HONG KONG, Apr 3, 2023 - (ACN Newswire) - Hong Kong is being actively promoted as a base for family offices, with many global tycoons considering setting up their offices here. Hong Kong's mature financial market and sound legal system provide a reassuring level of protection for family offices. To attract more family offices to the city, the Hong Kong SAR Government has introduced a range of favourable policies, including tax concessions and professional training, as well as consulting services to assist entrepreneurs and their family offices in managing and operating their wealth and assets more efficiently.

| | Ms. Jane Fraser, CEO Citigroup (left) and Mr. Dennis Tam, President and CEO Black Spade Capital (right) |

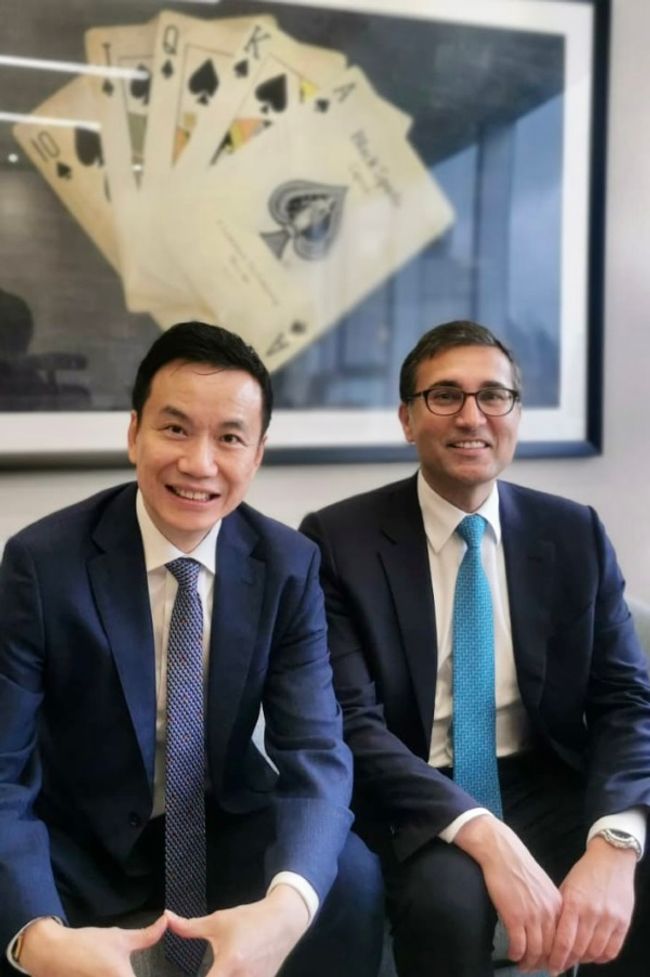

| | Mr. Dennis Tam, President and CEO Black Spade Capital (left) and Mr. Iqbal Khan, President Global Wealth Management & Member of the Group Executive Board UBS (right) |

Mr. Dennis Tam, President and CEO of Black Spade Capital, said: "As a family office headquartered in Hong Kong, Black Spade Capital believes that Hong Kong is an ideal destination for establishing family offices. We welcome the series of initiatives and policies introduced by the Hong Kong SAR Government to cement Hong Kong's position as a world-leading family office hub. Black Spade Capital will continue to support the development of family office businesses and will participate in ventures and investments that provide enhanced services and support for family office businesses."

"As the destination of choice for family offices, we are confident that family offices from all over the globe will appreciate the ample development opportunities and room for growth that Hong Kong has to offer." added Mr. Tam.

Recently, Black Spade Capital had the opportunity to meet with top leaders from the financial sector including Citigroup's CEO, Ms. Jane Fraser, and UBS's President Global Wealth Management & Member of the Group Executive Board, Mr. Iqbal Khan. Mr. Tam said: "Hong Kong's role as a bridge between the East and West makes it an ideal asset and wealth management centre for family offices. Its comprehensive financial-legal ecosystem attracts professionals and talents from different industries and parts of the world, making it an asset and wealth management centre that family offices need for long-term development. Black Spade Capital will maintain close collaborations with other family offices and related institutions to promote the development of family office businesses in Hong Kong."

About Black Spade Capital Limited

Black Spade Capital Limited is an established family office that manages the private investments of Mr. Lawrence Ho. Headquartered in Hong Kong, its global portfolio consists of a wide spectrum of cross-border investments as it consistently seeks to add new projects and opportunities to its investment mix. Black Spade's investment strategy maximizes coverage of geographic regions and sectors whilst maintaining a portfolio of diversified asset classes, ranging from equity, fixed income, medical technology, leisure and culture, green energy, real estate to Pre-IPO investments.

Topic: Press release summary

Source: Black Spade Capital Limited

Sectors: Daily Finance

https://www.acnnewswire.com

From the Asia Corporate News Network

Copyright © 2026 ACN Newswire. All rights reserved. A division of Asia Corporate News Network.

|

|

|