|

|

|

|

|

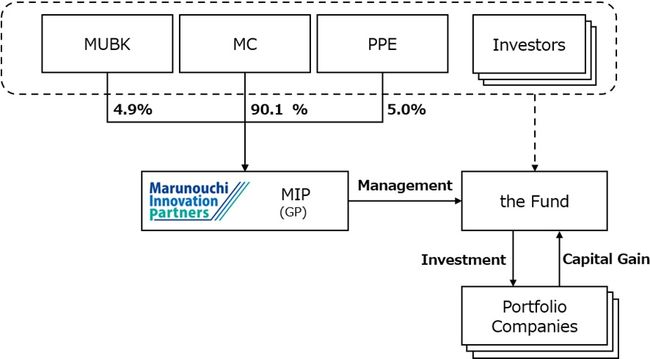

TOKYO, May 2, 2023 - (JCN Newswire) - Mitsubishi Corporation (MC) is pleased to announce the launch of Marunouchi Climate Tech Growth Fund L.P. (the Fund), which is managed by Marunouchi Innovation Partners Co., Ltd. (MIP), a company jointly established by MC, MUFG Bank Ltd. (MUBK) and Pavilion Private Equity Co., Ltd. (PPE). The Fund will invest primarily in companies dedicated to decarbonization through the development of climate tech. As of its initial closing, the Fund (including the related investment vehicles for overseas Investors) has raised 400 million USD of capital commitment from investors. MIP plans to raise new investment through additional rounds of funding and increase the size of the Fund to 800 million ~ one billion USD by its final closing.

| | Structure of the Fund |

In October 2021, MC unveiled its "Roadmap to a Carbon Neutral Society" and its aim to be a net-zero greenhouse-gas (GHG) emissions company by the year 2050. It has also committed to a new growth strategy under its latest management plan, "Midterm Corporate Strategy 2024 - Creating MC Shared Value," the main objective of which is to build a brighter future by jointly promoting energy (EX) and digital (DX) transformations. Through these initiatives, MC remains dedicated to addressing the challenges facing modern society and industry.

The field of climate tech has raised expectations with respect to accelerated development and application of a wide range of cutting-edge, net-zero technologies and solutions. With more funding crucial to meeting those expectations, the demand for climate tech investments is likely to grow over the medium to long term.

With the Fund prioritizing investments aimed at spurring growth in companies dedicated to climate tech solutions, MC and MIP shall leverage this opportunity to help commercialize, scale up and rollout those entities' cutting-edge technologies. As a result, the Fund should not only help to boost those entities' corporate value, but also support decarbonization and the realization of a carbon-neutral society. Furthermore, with the MC Group serving as its main sponsor, the Fund will take advantage of the group's broad industry expertise, business network and collective capabilities, and play an important role in connecting all of its strategic investors. MC and MIP are excited about the Fund's potential in securing blue-chip investment opportunities and supporting the growth of its portfolio companies.

For more information, visit www.mitsubishicorp.com/jp/en/pr/archive/2023/html/0000051198.html.

Inquiry Recipient:

Mitsubishi Corporation

Telephone:+81-3-3210-2171

Facsimile:+81-3-5252-7705

Topic: Press release summary

Source: Mitsubishi Corporation

Sectors: Alternative Energy

https://www.acnnewswire.com

From the Asia Corporate News Network

Copyright © 2026 ACN Newswire. All rights reserved. A division of Asia Corporate News Network.

|

|

|