TOKYO, Oct 18, 2023 - (JCN Newswire) - Mitsubishi Corporation (MC), through its wholly-owned subsidiary Mitsubishi Development Pty Ltd (MDP), forms BHP Mitsubishi Alliance (BMA), a metallurgical coal joint venture with BHP in Queensland, Australia.

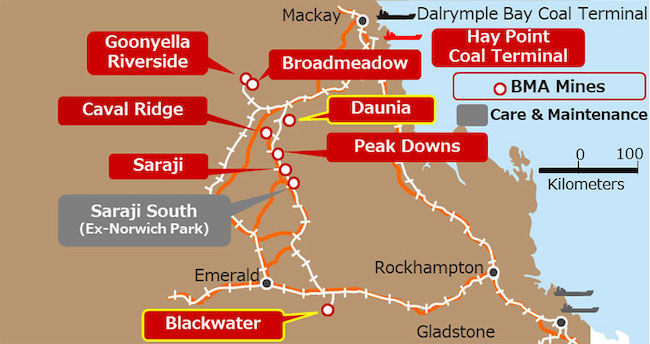

MDP and BHP have signed an asset sale agreement to divest the Blackwater and Daunia mines to Whitehaven Coal Ltd (Whitehaven) for cash consideration of up to US$4.1 billion. The Daunia and Blackwater mines are part of the BMA joint venture, which MDP and BHP equally own.

The purchase price is U$3.2 billion (U$2.1 billion to be received upon completion, the remaining U$1.1 billion to be received over three years following completion), with price linked contingent consideration of an aggregate of up to U$900 million payable over three years.

Whitehaven is an Australian coal producer listed on the Australian Stock Exchange (ASX). Whitehaven has a strong track record as a responsible and reliable operator, owning and operating four thermal and metallurgical coal assets in New South Wales. Whitehaven also owns a metallurgical coal mine in Queensland which is currently under development.

MC constantly reviews its mineral resources assets to ensure its portfolio is resilient. Following the divestment of these two coal mines, we are completing our focus on higher-quality metallurgical coal assets. We will continue to provide a steady supply of high-quality metallurgical coal from the remaining BMA assets, which form a core part of our mineral resources portfolio.

The divestment is expected to occur in JFY24 following the satisfaction of certain conditions including competition and regulatory approvals, with net proceeds to be received upon completion. BMA will continue to own and operate the Daunia and Blackwater mines until completion and will cooperate with Whitehaven to ensure a smooth ownership transition.

BMA’s high-quality metallurgical coal is expected to play an important role in reducing GHG emission intensity from blast furnace operations, as its use reduces the amount of fuel required in the steelmaking process. MC will continue to supply minerals needed to transition to a carbon-neutral society including high-quality metallurgical coal and iron ore. Moreover, MC will support the Energy Transformation (EX) by further developing its business in metals and minerals underpinning electrification, such as copper, aluminium/bauxite, lithium, and nickel, and establishing a footprint in a future circular economy.

Inquiry Recipient:

Mitsubishi Corporation

Telephone:+81-3-3210-2171

Topic: Press release summary

Source: Mitsubishi Corporation

Sectors: Energy, Alternatives

https://www.acnnewswire.com

From the Asia Corporate News Network

Copyright © 2026 ACN Newswire. All rights reserved. A division of Asia Corporate News Network.

|