HONG KONG, Mar 11, 2024 - (ACN Newswire) - In 2023, China's aluminum industry experienced vigorous growth, with data from the National Bureau of Statistics showing that aluminum production reached 63.034 million tons, marking a 5.7% year-on-year increase; electrolytic aluminum production reached 41.594 million tons, reflecting a year-on-year increase of 3.7%. This growth momentum was attributed to the gradual recovery of the real estate sector and the rapid expansion of the renewable energy industry.

The widening gap between supply and demand for electrolytic aluminum drove aluminum prices upward, leading to continuous improvement in profit and profitability for China Hongqiao Group Ltd ("China Hongqiao"). As of the first nine months of 2023, its core operating entity, Shandong Hongqiao, achieved a cumulative revenue of RMB 97.866 billion and a net profit of RMB 6.525 billion. Notably, Shandong Hongqiao's net profit surged by 226.2% year-on-year in the third quarter, with a remarkable quarterly increase of 167.9%, indicating sustained robust growth for China Hongqiao. Analysts hereby summarize the previous offshore bond, and focus on HONGQI 6.25 06/08/24.

The price of China Hongqiao's USD bonds has remained stable. Analysts attribute this stability to the company's solid fundamentals, longstanding active performance in offshore capital markets and the close ties with investment institutions.

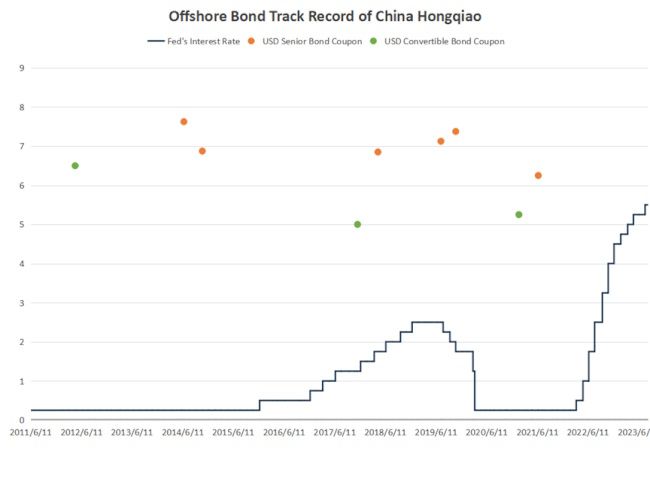

The following part has compiled China Hongqiao's offshore market track record. The company issued its first convertible offshore bond in 2012 and has since issued a total of 9 offshore bonds (6 senior bonds and 3 convertible bonds), amounting to a total issuance scale of USD 2.92 billion. Well-known asset management companies such as UBS, E Fund and Schroders all have long-term investments in China Hongqiao.

As shown in the chart below, despite the market volatility caused by the Fed's interest rate hikes, China Hongqiao's offshore bond pricing has remained stable overall, ranging between 5% and 7.7%. The company's most recent issue, HONGQI 6.25 06/08/24, priced in June 2021 at USD 500 million with a coupon rate of 6.25%, was widely recognized among investors, with its order book reached up to seven times its issue size.

China Hongqiao's investors have been growing continuously due to three main reasons:

Firstly, the company's fundamentals are promising. As the world's second-largest primary aluminum producer, it has substantial production capacities in bauxite, alumina, electrolytic aluminum, and fabricated aluminum processing.

Secondly, it is highly competitive within the industry. The company has been rated "BB" by the major credit rating agencies. Although the rating is slightly lower than Alcoa Corporation, China Hongqiao benefits from the scale and efficiency of its core business, achieving a higher EBITDA margin than Alcoa Corporation.

Thirdly, similar high-yield dollar bond investments are relatively scarce. The downturn in the domestic real estate industry has resulted in difficulties for developers in the issuance markets, limiting options for high-quality, high-yield dollar bond investments. Since 2023, the only high-yield bond in the industrial sector was issued by Wynn Resorts.

Moreover, many foreign institutional investors have become more prudent in investment after experiencing the real estate down cycle. They tend to favor issuers with a solid record of bond issuance, higher ratings, and stable cash flows. Therefore, to meet investors' demand for high-quality Chinese offshore assets, investment institutions seek continued issuance of offshore debt by China Hongqiao.

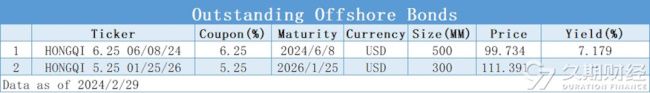

Currently, China Hongqiao has only two outstanding USD bonds: HONGQI 6.25 06/08/24 (senior bond) and HONGQI 5.25 01/25/26 (convertible bond). With the maturity of HONGQI 6.25 06/08/24, market uncertainties arise regarding whether China Hongqiao will issue offshore bonds again. If the company chooses repayment over new issuance, it will be a significant loss for the investors.

With China Hongqiao's strong liquidity on its balance sheet, its subsidiary Shandong Hongqiao successfully issued short-term and medium-term notes of 1 billion respectively in January. However, because of the high exchange rate between RMB and USD, the trend in offshore bond issuance is tightening. Therefore, if the company chooses to repay HONGQI 6.25 06/08/24, it may face new challenges in the future. New burdens could result from the high exchange rate, tightening trend in offshore bond issuance and potential reversal in the inverted yield curve.

There are many experienced offshore bond issuers in the market who maintain a stable issuance frequency throughout the year. This regular issuance not only helps uphold the issuer's market position and reputation but also helps improve the yield curve and facilitates ongoing communication with institutions. Taking Shandong Commercial Group Co. Ltd. as an example, it has issued at least one offshore bond annually since 2020, showcasing a consistent financing strategy.

Benefiting from the surge in demand for electrolytic aluminum and its strong fundamentals, China Hongqiao's position in the offshore capital market is becoming increasingly solid. However, given the current market environment and policy changes, the market is concerned about whether it will issue offshore bonds again. Investors are recommended to keep track of the company's news as well as the market trend, to seize the potential investment opportunities.

Topic: Issue of Stocks/Bonds

Source: China Hongqiao Group Limited

Sectors: Metals & Mining

https://www.acnnewswire.com

From the Asia Corporate News Network

Copyright © 2026 ACN Newswire. All rights reserved. A division of Asia Corporate News Network.

|