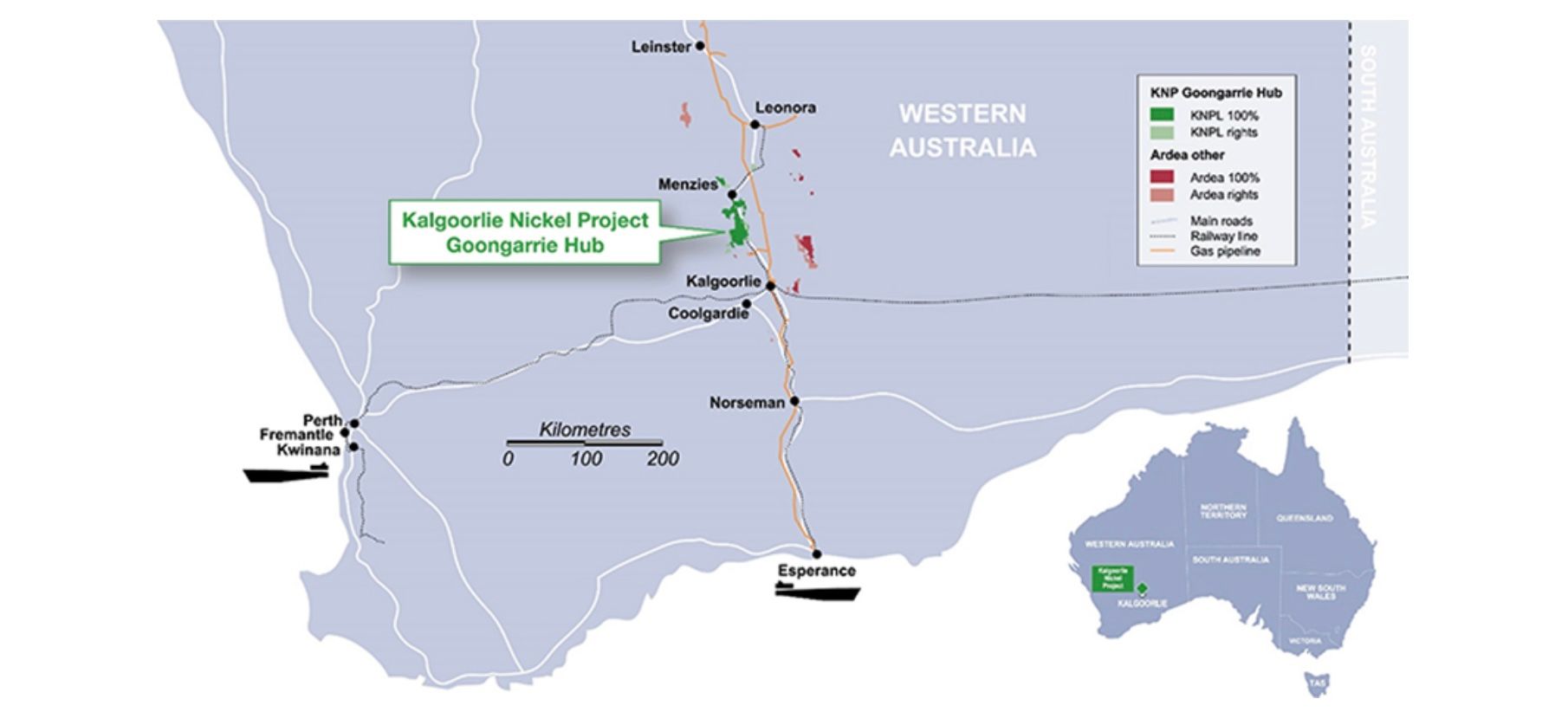

TOKYO, Apr 30, 2024 - (JCN Newswire) - Sumitomo Metal Mining Co., Ltd. (TSE: 5713, SMM) and Mitsubishi Corporation (TSE: 8058, MC) have entered into a binding agreement with Ardea Resources Limited (ASX: ARL, Ardea) to participate in the development of the Kalgoorlie Nickel Project (KNP) - Goongarrie Hub.

SMM and MC will establish an incorporated joint venture to fund the KNP – Goongarrie Hub Definitive Feasibility Study (DFS) up to the agreed budget of 98.5 million AUD. The SMM-MC joint venture will acquire an ultimate 50%(1) interest in Kalgoorlie Nickel Pty Ltd (KNPL), the owner of the project and currently 100% held by Ardea.

Located in Western Australia, KNP - Goongarrie Hub is one of the world's largest nickel deposits, expected to produce approximately 30,000 tonnes of nickel and 2,000 tonnes of cobalt per annum over a 40-plus-year mine life. The SMM-MC joint venture will leverage SMM's expertise in nickel and cobalt extraction from low-grade nickel oxide ore using the High Pressure Acid Leach (HPAL) process, combined with MC's extensive experience and track record in the Australian mining sector to assess the feasibility of KNP – Goongarrie Hub. Through collaborative efforts between the joint venture and Ardea, the DFS is expected to commence during the first half of 2024 and be completed by the second half of 2025.

SMM and MC will be supported with a grant provided by Japan's Ministry of Economy, Trade and Industry that is intended for securing critical mineral supply stability in Japan.

SMM possesses fully integrated nickel supply chains from ore to metals, chemicals and battery materials. SMM will continue to be proactive on securing source of the critical mineral towards one of its Long-term Vision's targets of 150,000 tonnes nickel annual production capacity.

MC, in its "Midterm Corporate Strategy 2024 – Creating MC Shared Value" released in May 2022, outlined its growth strategy of accelerating energy transformation, including investment in nickel resources. Beyond this Strategic Investment, MC remains committed to further securing a stable and sustainable supply of battery minerals.

(1) SMM and MC to jointly acquire a 17.5% interest in KNPL upon funding 50% of the DFS budget, an additional 17.5% interest upon completion of the DFS, and an additional 15.0% interest upon approval of the final investment decision.

For more information, visit https://www.mitsubishicorp.com/jp/en/pr/archive/2024/html/0000053701.html.

Inquiry Recipient:

Mitsubishi Corporation

Telephone:+81-3-3210-2171

Topic: Press release summary

Source: Mitsubishi Corporation

Sectors: Metals & Mining

https://www.acnnewswire.com

From the Asia Corporate News Network

Copyright © 2026 ACN Newswire. All rights reserved. A division of Asia Corporate News Network.

|