|

|

|

|

|

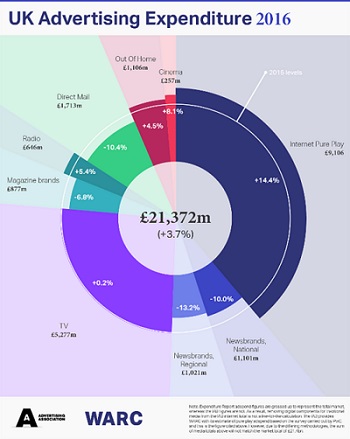

LONDON, Apr 25, 2017 - (ACN Newswire) - UK advertising expenditure grew 3.7% to reach GBP 21.4bn in 2016, the seventh consecutive year of market growth, according to the Advertising Association/WARC Expenditure Report - the UK's definitive advertising statistics.

| | UK Advertising Expenditure 2016 |

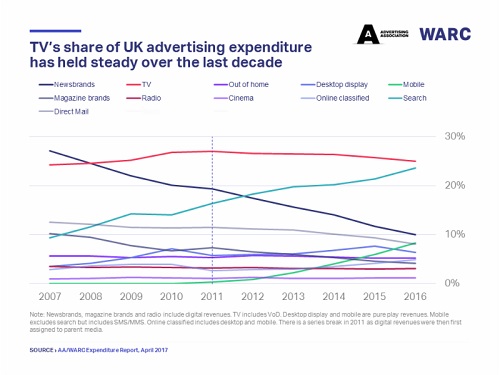

| | UK Advertising Expenditure 2007-2016 |

|

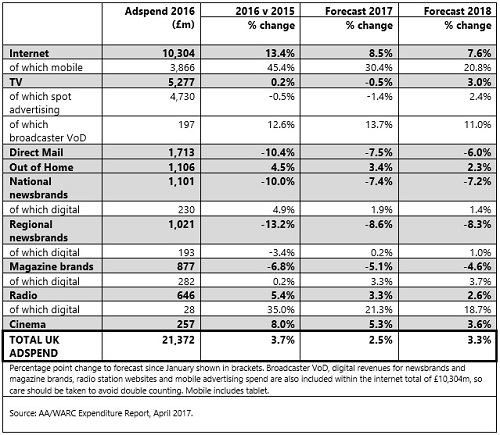

Growth in UK adspend held steady in Q3 after the June referendum, before reaching GBP 5.8bn in Q4 2016, a rise of 3.9% year-on-year and the highest grossing quarter on record. In real terms, after accounting for inflation, UK adspend topped its pre-recession peak for the first time during both the final quarter and for 2016 as a whole. Forecasts for the next two years indicate continued growth of 2.5% in 2017 and 3.3% in 2018.

Digital formats continued to drive growth in 2016, with internet adspend up by 13.4% to GBP 10.3bn, with mobile accounting for 99% of that growth. Mobile spend reached GBP 3.9bn, with 86% of the current value of the mobile advertising market generated in just the past five years.

Digital accounted for 38% of the GBP 1.1bn out of home advertising market in 2016, double the share digital recorded in 2012, while revenues from online ads were up for national newsbrands (+4.9% to GBP 230m) for the fifth year running.

TV adspend, boosted by 12.6% growth in video-on-demand revenue, recorded a new high of GBP 5.3bn in 2016, with TV's share of overall spend holding steady at 25% over the last decade. Annual growth in adspend was also recorded for cinema (+8% to GBP 257m) and radio (+5.4% to GBP 646m) in 2016.

Stephen Woodford, Chief Executive at the Advertising Association said:

"Advertising has proved resilient to uncertainty and behind these numbers is a cutting edge, digital business in which Britain is a world-beater. As we work towards Brexit, we're urging Government to support UK advertising and do more to unlock its potential to grow UK plc."

James McDonald, Senior Data Analyst at WARC commented:

"The UK's ad industry is experiencing the most seismic shift since WARC began monitoring in 1982. Last year exemplified this, as over 95% of the new money entering the market came from digital formats. The trend will continue as ad tech improves and consumers spend more time with their internet-connected devices."

The Advertising Association/WARC Expenditure Report is the definitive measure of advertising activity in the UK. It is the only source that uses advertising expenditure gathered from across the entire media landscape, rather than relying solely on estimated or modelled data. With total market and individual media data available quarterly from 1982, it is the most reliable picture of the industry and is widely used by advertisers, agencies, media owners and analysts.

At-a-glance media summary, Q4 2016

- Internet adspend rose 15.3% during Q4 2016, pushing the full-year total above GBP 10bn for the first time. Mobile accounted for 99% of the new money entering the internet ad market last year.

- Television adspend dipped 2.1% in the final quarter of 2016, though this was counter-balanced by rises earlier in the year, resulting in 0.2% growth for 2016 as a whole. Total TV spend is expected to dip this year, before the losses are regained in 2018.

- Radio adspend rose 7.7% to a record-high level during the last three months of 2016, buoyed by the strongest growth in spot revenue since Q4 2014. Other than internet, radio was the only medium to gain share of total adspend in 2016 (+0.1pp vs. 2015).

- Out of home (OOH) spend grew by 2.0% year-on-year during the final three months of 2016, supported by a 22.7% rise in digital ad expenditure. Full-year adspend rose for the sixth consecutive year in 2016, and further sector growth is forecast this year and next.

- National Newsbrands' combined ad revenues fell 9.0% during Q4 2016. The 10.0% dip recorded during 2016 as a whole was, however, GBP 25m softer than the loss recorded in 2015. The rate of decline is expected to ease further over the forecast period.

- Regional Newsbrands' ad income dropped across print (-16.7%) and digital (-1.1%) formats in the final quarter of 2016, with combined full-year revenues down 13.2%. As with national newsbrands, the rate of decline is forecast to soften over the coming years.

- Magazine brands recorded losses in income from both print (-9.1%) and digital (-5.7%) ads in Q4, though full-year digital revenues rose 0.2% thanks to growth among publishers of consumer titles.

- Cinema adspend grew for the third consecutive year in 2016, topping 2015's peak by 8.0% to reach GBP 257m. The full-year total was boosted by the highest quarterly spend on record during Q4.

- Direct Mail adspend was down 9.2% in Q4 2016, and full-year spend was 10.4% lower than in 2015. As with other printed formats, the severity of annual dips in ad revenue is expected to ease.

About the Advertising Association/WARC Expenditure Report

The Advertising Association/WARC quarterly Expenditure Report is the definitive guide to advertising expenditure in the UK. Impartial and independent of any media channel or agency affiliation, it is the only source of historical quarterly adspend data and forecasts for the different media for the coming eight quarters. With data from 1982, this comprehensive and detailed review of advertising spend includes the AA/WARC?s own quarterly survey of all national newspapers, regional newspaper data collated in conjunction with Local Media Works and magazine statistics from WARC?s own panels. Data for other media channels are compiled in conjunction with UK industry trade bodies and organisations, notably the Internet Advertising Bureau, Outsmart, Radiocentre and the Royal Mail.

All data are net of discounts and include agency commission, but exclude production costs. The survey was launched in 1981 and has produced data on a quarterly basis ever since.

Methodology for WARC's quarterly forecasts

Analysis of annual adspend data over the past 35 years shows that there is a link between annual changes in GDP and annual changes in adspend (after allowing for inflation, and excluding recruitment adspend). Over this period, GDP changes account for about two thirds of the change in adspend. WARC has developed its own forecasting model to generate forecasts for two years based on assumptions about future economic growth. The model provides an indication of likely overall spend levels ? adjusted to allow for short-term factors (Olympics, World Cup etc).

The Expenditure Report (www.warc.com/expenditurereport) launched online in February 2010 and combines data from the discontinued print publications the Quarterly Survey of Advertising Expenditure and the Advertising Forecast. It is relied upon daily by the world?s largest brands, ad agencies, media owners, investment banks and academic institutions. Alongside over 200 ready-made tables, subscribers can create their own customised tables for analysis of different media and time periods, as well as track the different media?s share of adspend. All reports can be exported from the online interface. An annual subscription is priced at ?760 for AA members and ?1,175 for non-members.

About the Advertising Association

The Advertising Association promotes the role, rights and responsibilities of advertising and its impact on individuals, the economy and society. We are the only organisation that brings together agencies, brands and media to combine strengths and seek consensus on the issues that affect them. Through wide-reaching engagement and evidence-based debate we aim to build trust and maximise the value of advertising for all concerned.

Contact:

Amanda Benfell

PR Manager, WARC

Email: amanda.benfell@warc.com

Tel: +44 20 7467 8125

Stephanie Richani

Advertising Association

Email: stephanie.richani@adassoc.org.uk

Tel: +44 20 7340 1100

Topic: Press release summary

Source: Warc / Advertising Association

Sectors: Media & Marketing, Advertising

https://www.acnnewswire.com

From the Asia Corporate News Network

Copyright © 2026 ACN Newswire. All rights reserved. A division of Asia Corporate News Network.

|

|

|

|

|

|

|

|